Loan Apply

A loan is a sum of money borrowed from a financial institution or employer that is expected to be paid back with interest over time. Loans are typically given to employees for various personal or professional reasons and are repaid in installments through payroll deductions or other agreed-upon methods.

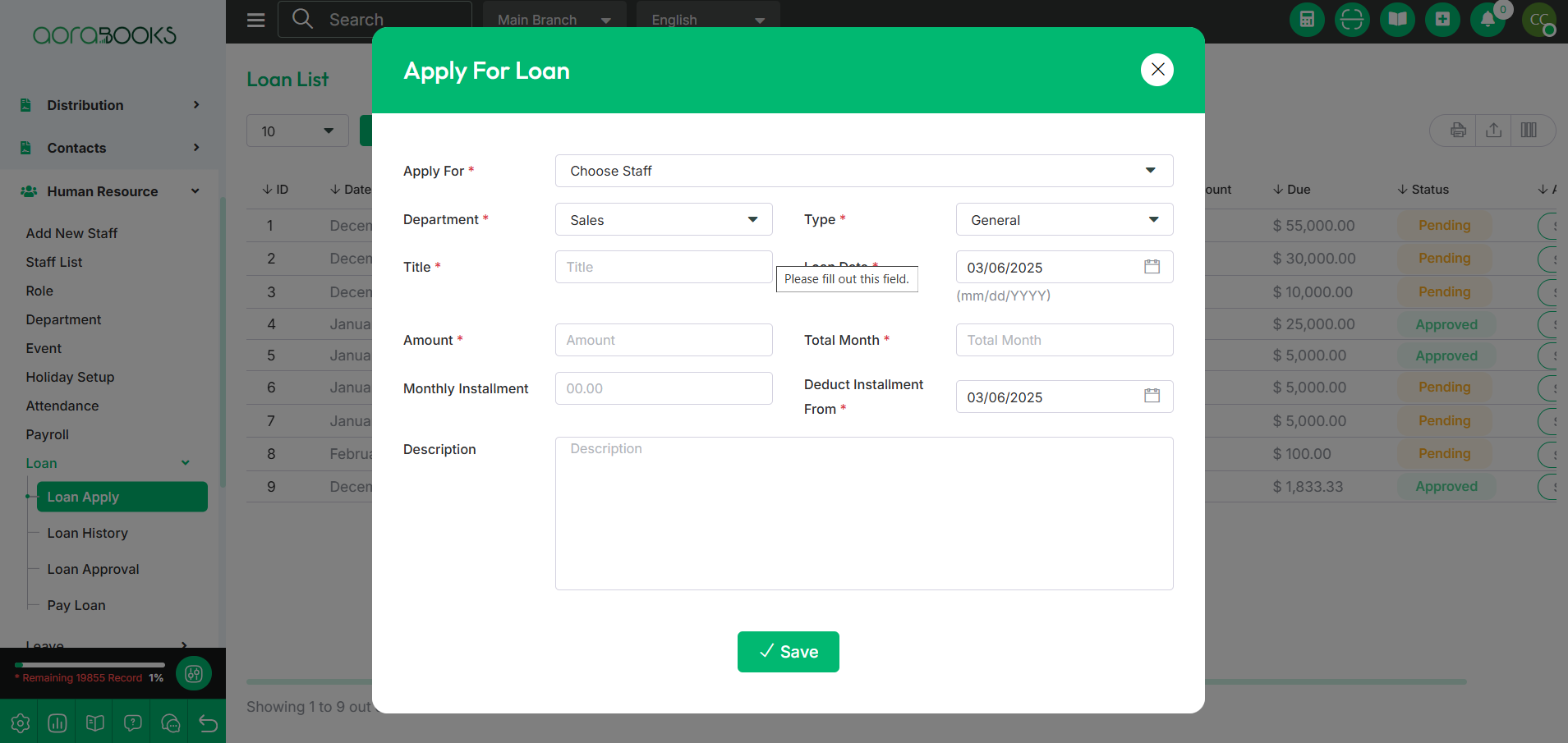

Loan Apply refers to the process where an employee requests a loan from their employer or a financial institution. To apply for a loan, just click on the “Apply For Loan” button and follow the below steps:

Apply For: Choose the staff member who is applying for the loan.

Department: Choose the department of the staff applying for the loan.

Title: Set the title of the loan.

Type: Select the type of the loan.

Date: Set the date when the staff member is applying for the loan.

Amount: Specify the loan amount being requested.

Total Month: Set the total months for the loan repayment.

Monthly Installment: Set the monthly installment amount.

Deduct Installment from: Choose the source for deducting the installment

Description: Add a description or purpose of the loan.

Save: Click the save button to finalize and submit the loan request.

This process ensures that the loan application is documented and processed for further approval.

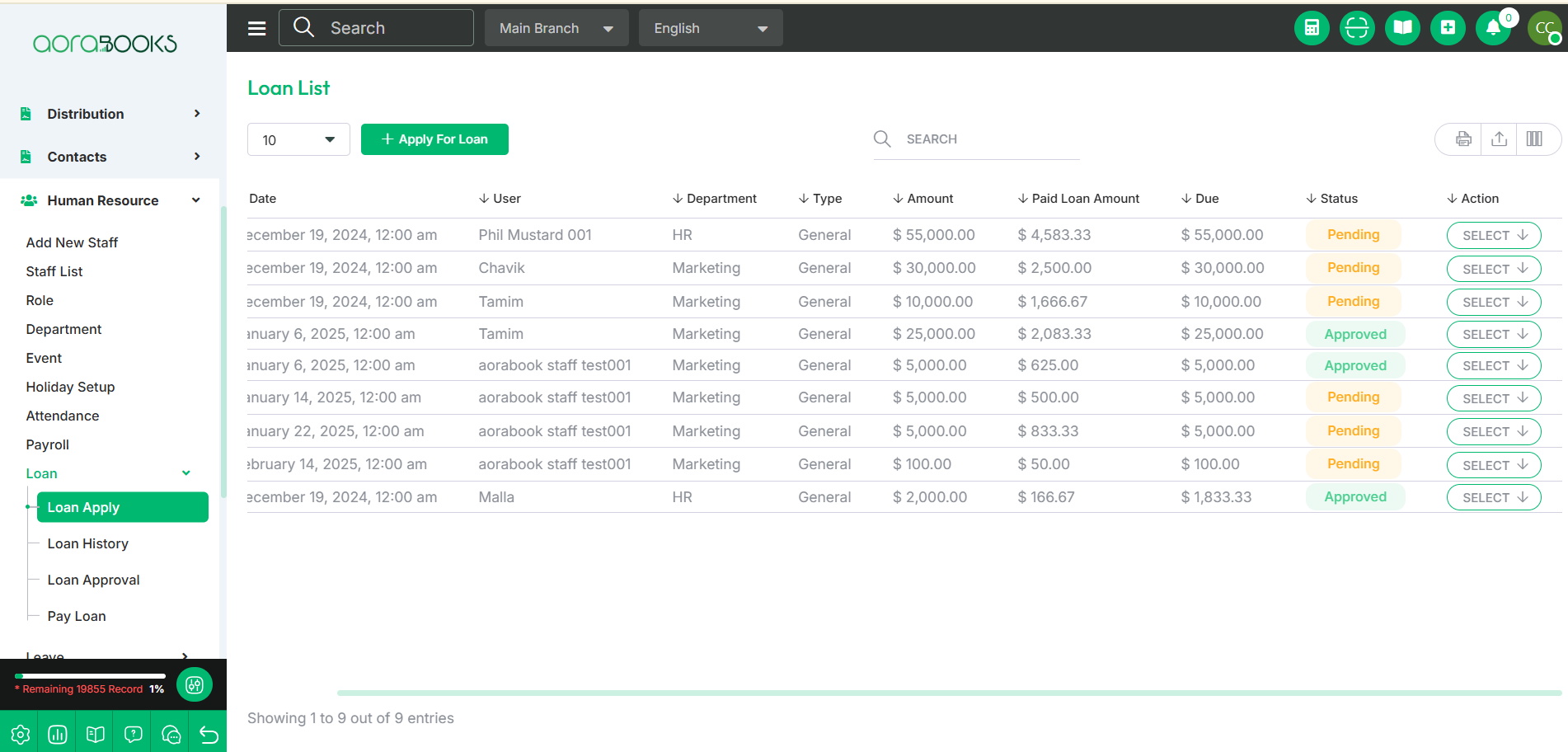

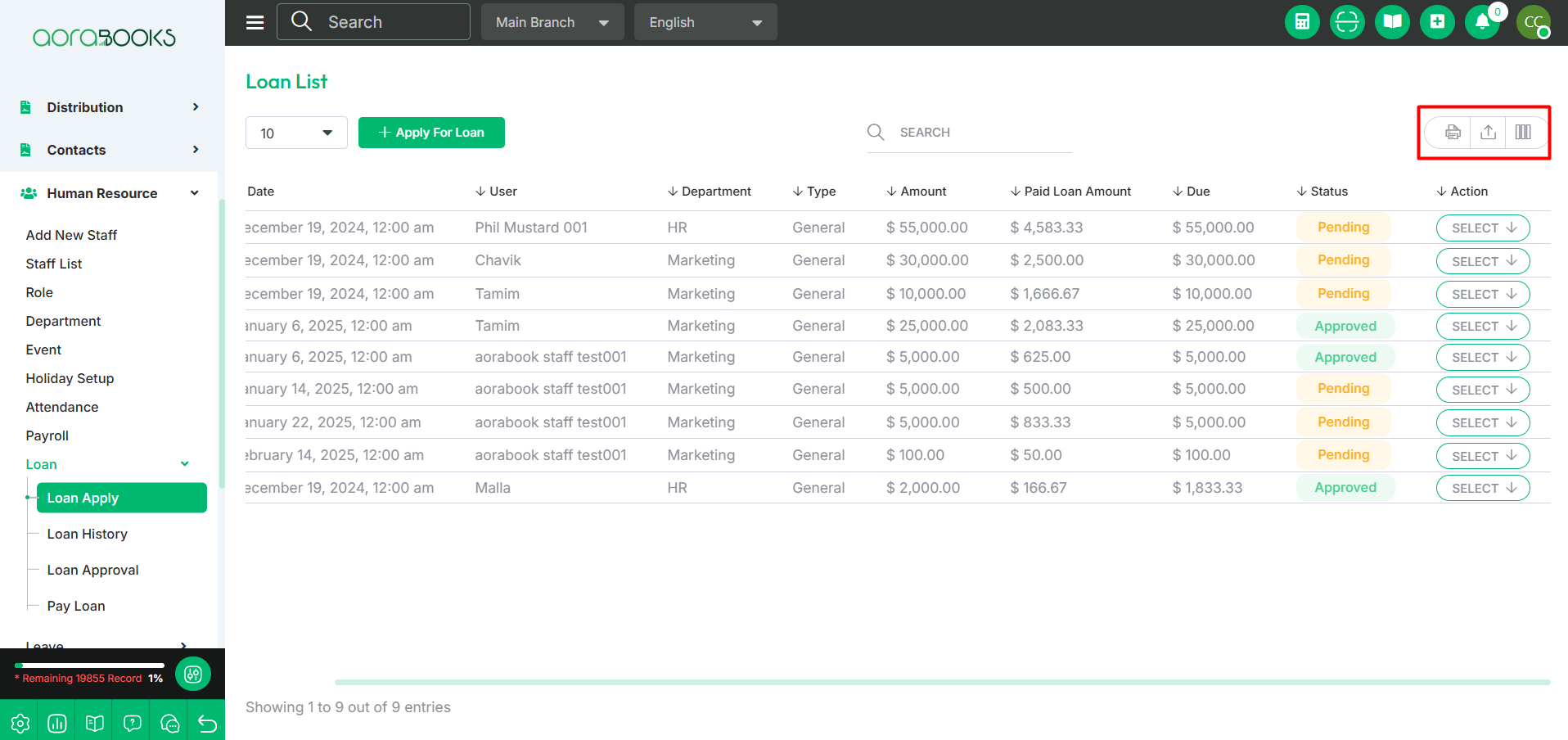

After successfully creating the loan request, you can see it in the loan list with the following details:

Date: The date when the loan application was made.

User: The staff member who applied for the loan.

Department: The department of the staff member applying for the loan.

Type: The type of loan applied for.

Amount: The total loan amount requested.

Paid Loan Amount: The amount of the loan that has been paid so far.

Due: The remaining loan balance.

Status: The current status of the loan (e.g., pending, approved, rejected).

Action: Options for actions you can perform on the loan .

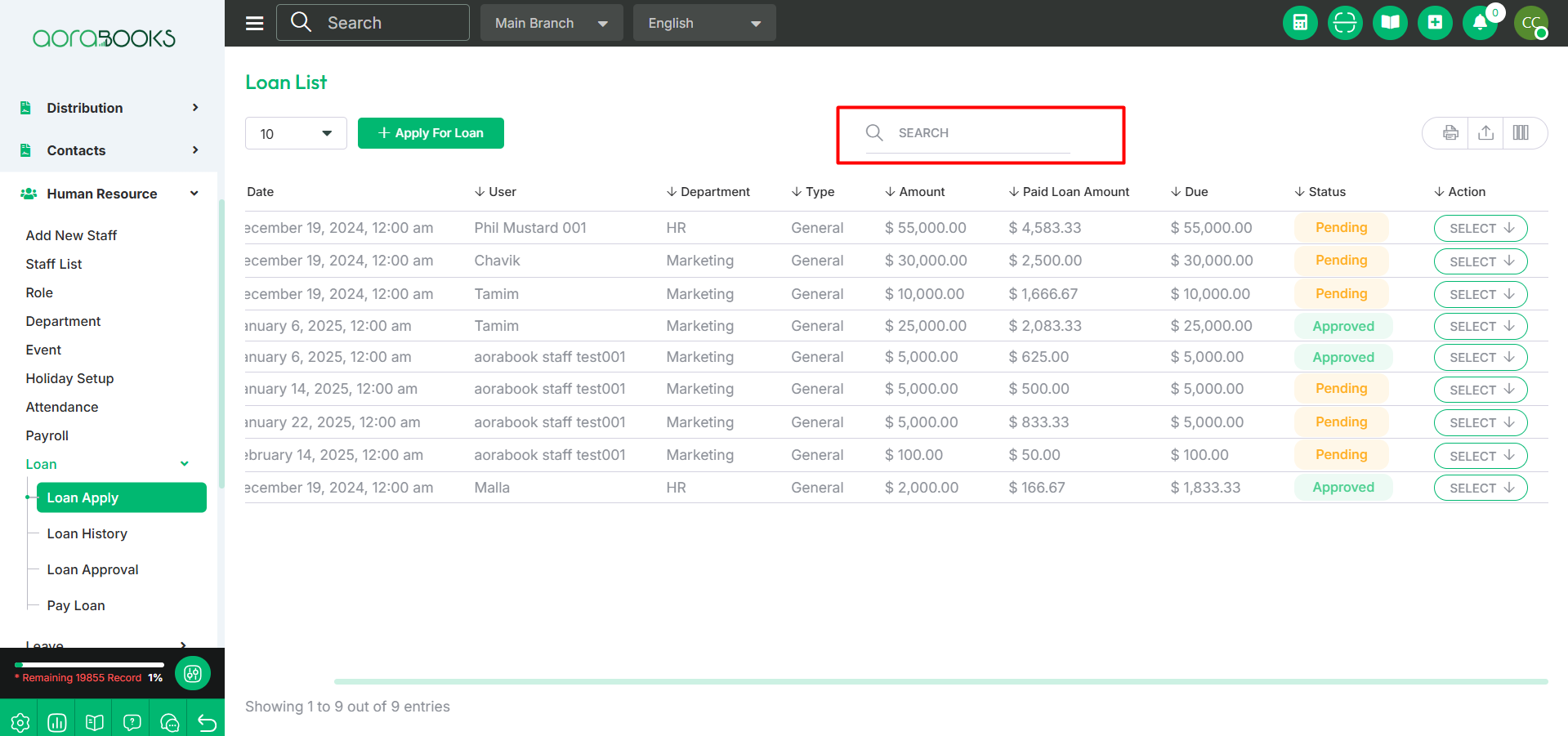

Search : You can find out any specific loan from the list by using the search.

Export Data: You can export the data table from here.

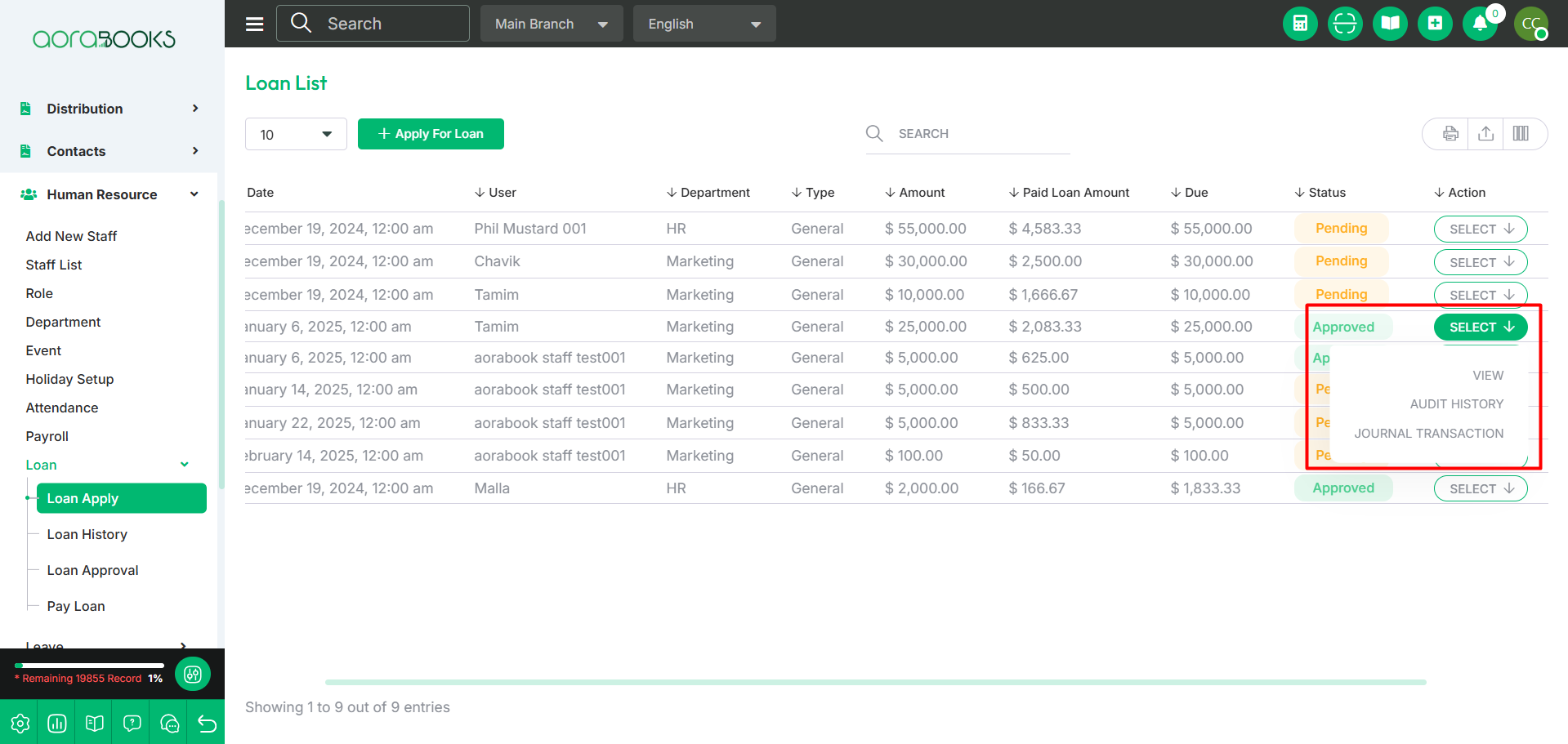

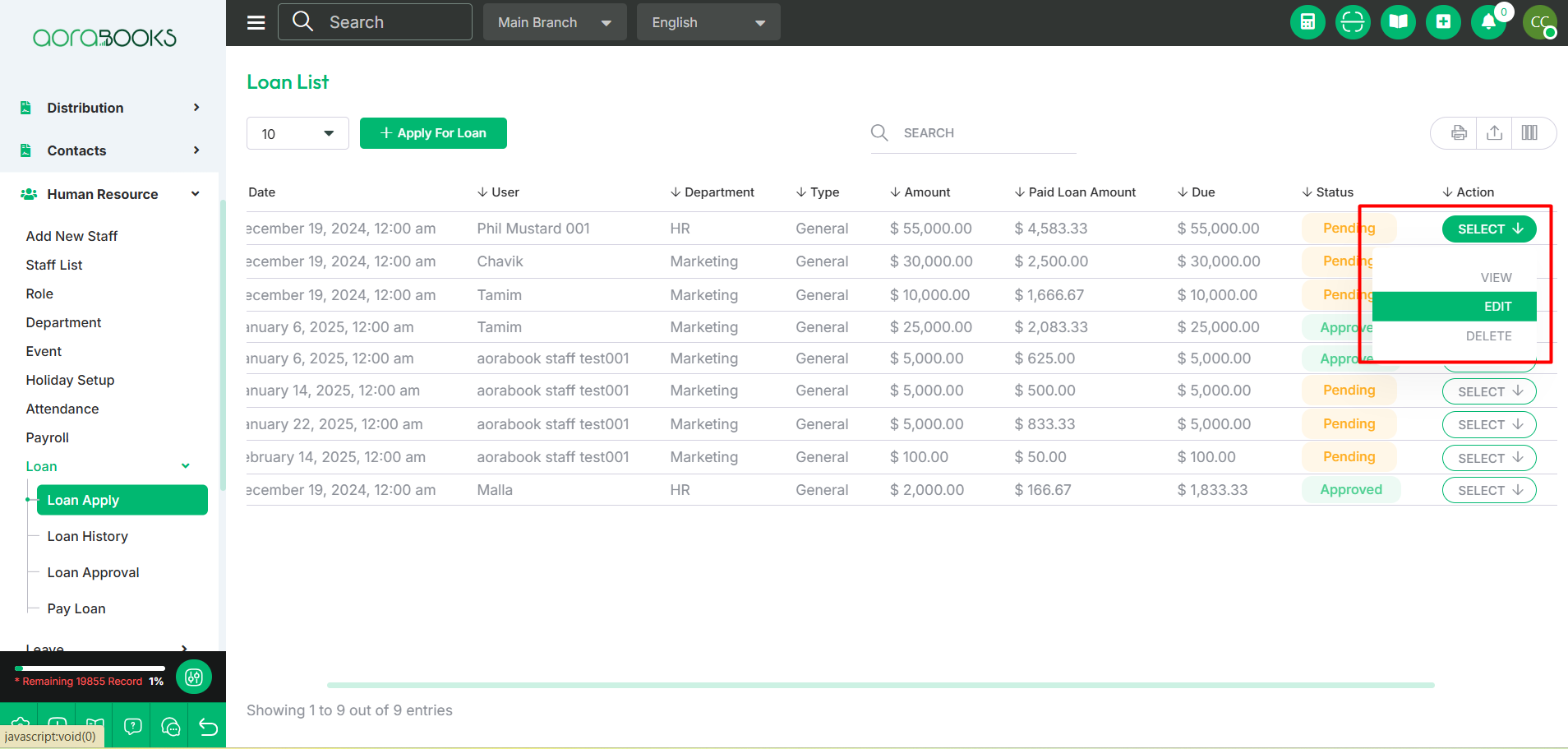

By clicking the select button, if your loan status is pending you can perform the below actions:

View: You can view the details of the loan.

Edit: You can modify the loan details.

Delete: You can delete the loan request from the list.

By clicking the select button, if your loan status is approved, you can perform the following actions:

View: You can view the details of the loan.

Journal Transaction: You can view or manage the journal transactions related to the loan.

Audit History: You can view the audit history of the loan, including changes and updates made over time.